There is a lot of excitement in the air about the use and further development of immunotherapies in oncology. For many, this is a huge step in the positive direction for how physicians will treat cancer patients in the future. There is much hope, despite some initial concerns about reduced efficacy in some patient subsets, resistance development, and toxicity issues. Many companies, developing and investing in these new therapeutic options, are actively seeking collaborations with smaller biotechnology companies through combination studies in order to bolster their product’s efficacy. In 2015, Peregrine Pharmaceuticals signed a partnership agreement with AstraZeneca to advance their compound bavituximab and in order to study the drug as a combination therapy in clinical trials. Synergy, as opposed to generating additive effects, is the name of the game and everyone is scrambling to get there first. Some companies, like Pfizer, are even using artificial intelligence, through partnerships with companies like IBM Watson, to navigate through complex and deep data sources in order to accelerate their drug discovery and launch timelines.

According to the 2016 Tufts Center for the Study for Drug Development report, more than 130 biotechnology companies and 20 pharmaceutical companies are reported to be working on an immuno-oncology agent, and the number of joint partnerships has increased from 6 to 58 in under 3 years. Pharma companies, with their deep pockets and a penchant to drive their pipelines, are all competing for the coveted assets found in smaller, nimbler organizations. In 2015, Celgene purchased 10% of Juno Therapeutics giving them access to their immuno-based treatment technology. Another example of a successful bidder was Pfizer when they managed to out-compete Amgen, Gilead, and AstraZeneca in 2016 for the purchase of Medivation, for their standout product Xtandi, and for their solid tumour pipeline. Unfortunately, not all partnerships result in oncology leadership from a research and development standpoint, as was noted when Sanofi bought out Genzyme in 2011.

Yervoy (ipilimumab, Bristol Myers Squibb), a first-generation agent, was approved in the US in 2011 for advanced melanoma. Next in line were checkpoint inhibitors such as nivolumab, pembrolizumab, and atezolizumab, which were approved for multiple indications and are used to help the immune system systematically and accurately target and kill tumor cells. Now, third-generation agents lie on the horizon, all promising to target wider components of the immune system. With expanded possibilities for combination with other therapeutics and the ability to pinpoint subsets of patients who will benefit most from companion diagnostics and biomarkers, the future looks bright for many hopeful drug candidates.

Having said all that, the development of resistance to these immunotherapies continue to pose challenges for manufacturers. Companies are assessing the utilization of mutation and biomarker tests which will enable oncologists to uncover a tumor’s primary resistance mechanism (ie. adaptive or acquired) as well as mutation patterns. This will help to determine how these drugs can be personalized for each unique cancer patient’s needs moving forward. In addition, combinations of checkpoint inhibitors with second-generation immunotherapies, or with other checkpoint inhibitors, are being actively studied. For example, ipilimumab has been combined with pembrolizumab (two checkpoint inhibitors) showing synergistic and improved efficacy when compared to the standard of care in unresectable or metastatic melanoma and with minimal additive toxicity.

With all of the excitement, however, the tide of enthusiasm is gently held back by the impending knowledge of budget constraints and increased competition. Combination treatments will result in very high costs and with the imminent changes happening with The Canadian Agency for Drugs and Technologies in Health (CADTH) which include their eventual evolution to an HTM organization (instead of an HTA organization), companies are needing to be very strategic in their partnership, clinical trial and launch timing decisions. Canada’s move towards amendments with the Patented Medicines Regulations (PMPRB’s list of comparator countries and the introduction of other factors so that the value of money and affordability can be taken into consideration) as well as the eventual co-union with Health Canada, the pCPA and other crown agencies under a single CADTH banner, is making a National Pharmacare program a much stronger possibility. Consolidation and centralization, including new cost sharing plans such as indication-specific pricing, is also something that is being actively considered and navigated in the US and European countries as governments rally to rein in the anticipated future costs of cancer care.

Fortunately Impetus Digital can assist many manufacturers with establishing an advisory board platform, leveraging the expertise of select stakeholders to give timely and expert advice on how best to navigate, launch, or increase brand awareness in the immuno-oncology space. Key questions can be posed to customer advisors such as:

- What indications should be initially sought after based on market competition and the timing of imminent entrants?

- What partnerships will set the company up for the greatest level of success from the standpoint of therapy combinations, pricing and market share opportunities?

- How should your immuno-oncology product be positioned and marketed: as an “ingredient” brand, “add-on,” or as a “booster drug” to an existing therapy? Or perhaps the best strategy is to pursue “market leader” or “key backbone” therapy depending on the micro-niche selected, the number of competitors in the market, and the relationship to the “first to market” position.

- How should your immuno-oncology product be positioned from a clinical practice and treatment algorithm standpoint? Does the market require clearer treatment guidelines or is a consensus document required?

- How should the patient voice be incorporated into your clinical and marketing plans for this immuno-oncologic?

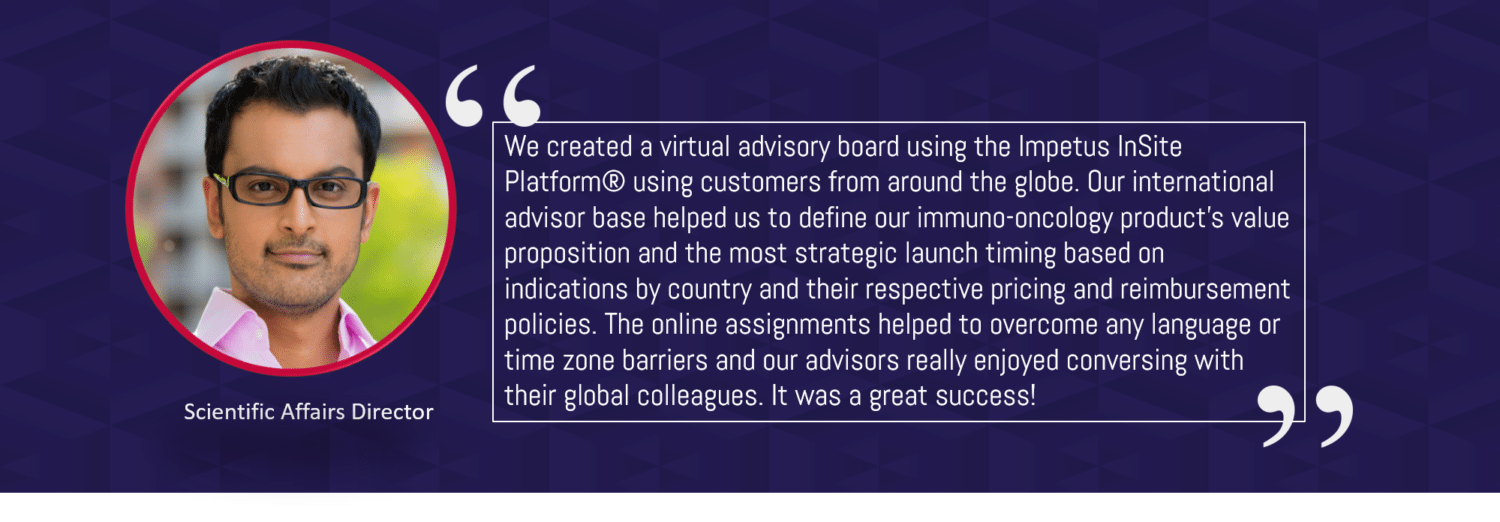

Stakeholders can include oncologists, GPOs, nurses, other allied healthcare providers, payers, and patients. Enrolled advisors can be engaged through a series of online touchpoints either in the form of web meetings or online asynchronous assignments delivered as survey questions via InSite Surveyor™, discussion questions via InSite Exchange™, or annotation exercises. Through these series of advisor online touchpoints, manufacturers can solicit feedback on their regulatory, market access, medical, or marketing strategies, as well as gain insights on how to navigate around generics and biosimilars entering the market. They can also learn how to differentiate their product from other medications and how to position their product in treatment protocols. In addition, advisors can consist of geneticists and, through the use of small online working committees, can assist in the creation of diagnostic testing protocols or the development of biomarker service or channel strategies. Oncology advisors can also provide valuable feedback on launch planning, regulatory and reimbursement dossiers, patient assistance programs, private infusion clinic best practices, and loss of exclusivity strategies. Also, manufacturers can leverage virtual working groups to help develop clinical papers leveraging real-world data, medical education materials, press releases, and patient advocacy programs.

The virtual nature of the boards and working groups can help to increase the engagement rates of advisors who are often extremely busy and being utilized by multiple manufacturers for similar purposes. Also, the assignments, which are compelling, relevant, and timely, can give the advisors or steering committee members time to pause, reflect, process, and review their colleague’s comments on their own time, allowing for more thoughtful and granular insights shared through the online forums. All of the assignments are created, programmed, project managed, and reported out by Impetus and their technical team (medical subject matter experts); hence, the manufacturer’s workload is minimal and so are the costs when compared to more traditional in-person consultancy meetings. Leveraging a virtual advisory board to effectively plan and implement a successful immuno-oncology product launch is a time- and cost-effective solution with the added benefit of building strong customer advocacy in the process.